With Paysimpli Tax is not Scary!

One Platform

Many Solutions

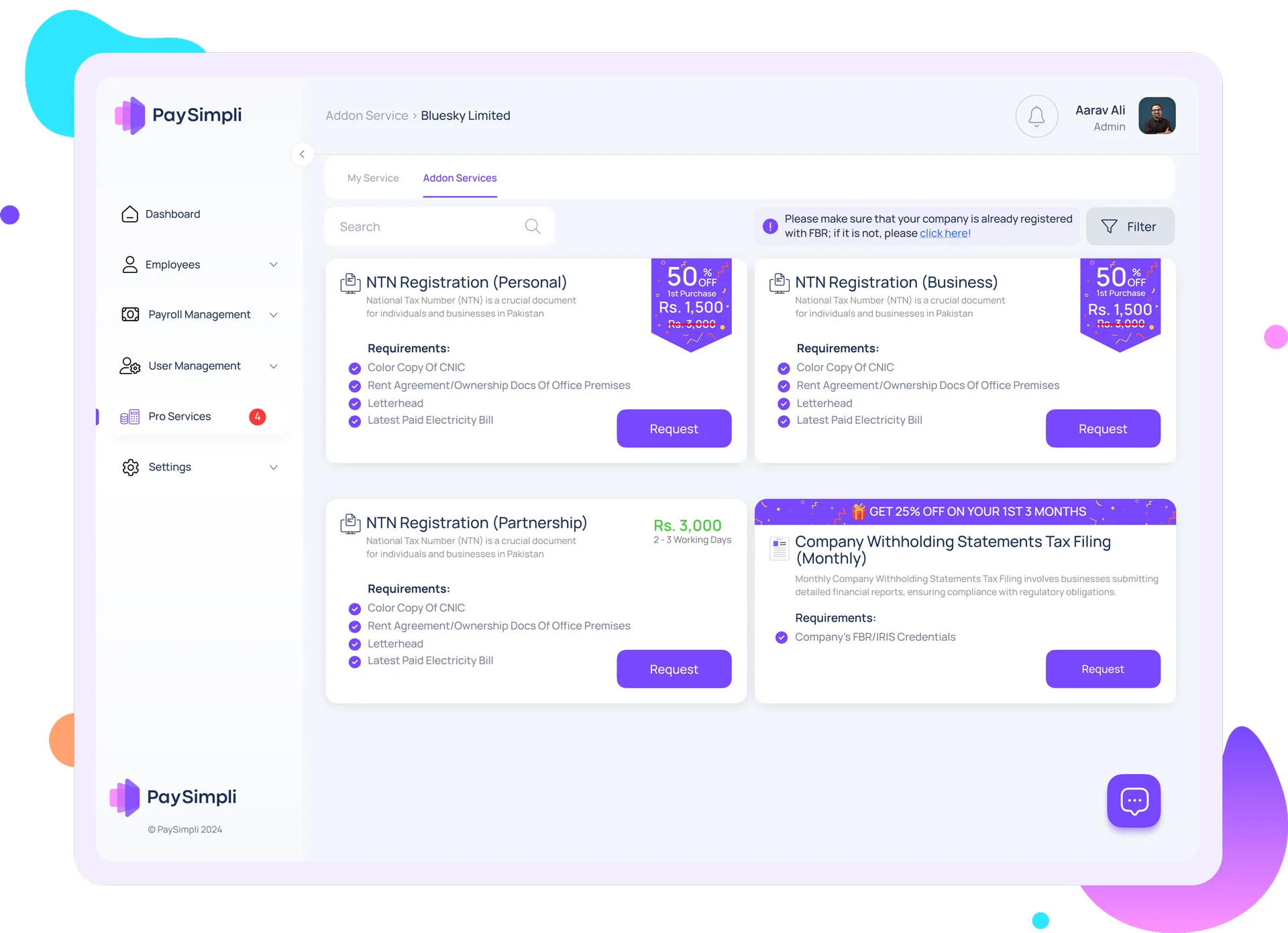

At PaySimpli, we simplify tax management with tailored fintech solutions. From tax filing to NTN registration and withholding tax, we've got you covered.

Income Tax Filing Salaried

Income Tax Filing (Salaried)

- Color copy of CNIC

- Email address

- Latest paid electricity bill

- 2-3 Working days

- Phone Number

How It Works?

Who needs to file it?

The current regulations set a PKR 600,000 threshold for taxable income. Individuals must file a tax return for any other taxable income or if they own certain assets.

How can you file it?

Gather required documents like salary slips, bank statements, and proof of deductions or exemptions. If unregistered, create an account on the FBR portal.

What is the benefits?

Claim payroll tax refunds for overpayments. Use deductions for medical expenses, donations, to lower taxable income. Keep organized financial records for better planning.

Reviews of People Who Have Used Our Services

I used PaySimpli for my income tax filing, and the process was simple. The platform guided me through income declaration and tax calculation, making filing before the Sept 30 deadline stress-free. Highly recommend!

Sara Ahmed

Great platform! Filing my taxes has never been easier. The user interface is straightforward and intuitive. I will definitely use it again next year.

Ali Raza

I used PaySimpli for my income tax filing, and the process was simple. The platform guided me through income declaration and tax calculation, making filing before the Sept 30 deadline stress-free. Highly recommend!

Bilal Hassan Qureshi

Exceptional customer service and user-friendly software. They answered all my queries promptly. Tax season is no longer a headache for me!

Emily

The detailed walkthroughs made it so easy to follow. PaySimpli takes the confusion out of tax returns. A lifesaver for those unfamiliar with tax procedures.

Jane Smith

Questions About Our Service

Income tax filing for salaried individuals involves declaring annual income to the Federal Board of Revenue (FBR) and calculating payable tax. Returns must be filed by September 30th, including income, expenses, and any applicable deductions or exemptions.

Income tax filing for salaried individuals involves declaring annual income to the Federal Board of Revenue (FBR) and calculating payable tax. Returns must be filed by September 30th, including income, expenses, and any applicable deductions or exemptions.

Income tax filing for salaried individuals involves declaring annual income to the Federal Board of Revenue (FBR) and calculating payable tax. Returns must be filed by September 30th, including income, expenses, and any applicable deductions or exemptions.

Income tax filing for salaried individuals involves declaring annual income to the Federal Board of Revenue (FBR) and calculating payable tax. Returns must be filed by September 30th, including income, expenses, and any applicable deductions or exemptions.

Income tax filing for salaried individuals involves declaring annual income to the Federal Board of Revenue (FBR) and calculating payable tax. Returns must be filed by September 30th, including income, expenses, and any applicable deductions or exemptions.